Systems | Development | Analytics | API | Testing

Fraud

5 Ways to Use Log Analytics and Telemetry Data for Fraud Prevention

How to Prevent Authorized Push Payment Fraud with Mobile App Testing

Fraud Detection with Cloudera Stream Processing

Fraud Detection With Cloudera Stream Processing Part 2: Real-Time Streaming Analytics

In part 1 of this blog we discussed how Cloudera DataFlow for the Public Cloud (CDF-PC), the universal data distribution service powered by Apache NiFi, can make it easy to acquire data from wherever it originates and move it efficiently to make it available to other applications in a streaming fashion.

Fraud Detection with Cloudera Stream Processing Part 1

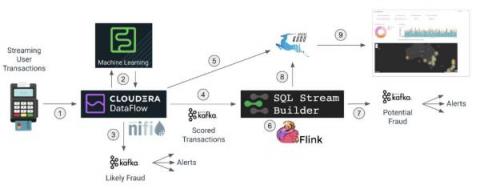

In a previous blog of this series, Turning Streams Into Data Products, we talked about the increased need for reducing the latency between data generation/ingestion and producing analytical results and insights from this data. We discussed how Cloudera Stream Processing (CSP) with Apache Kafka and Apache Flink could be used to process this data in real time and at scale. In this blog we will show a real example of how that is done, looking at how we can use CSP to perform real-time fraud detection.

Making the World a Better Place with Data

Much of the hype around big data and analytics focuses on business value and bottom-line impacts. Those are enormously important in the private and public sectors alike. But for government agencies, there is a greater mission: improving people’s lives. Data makes the most ambitious and even idealistic goals—like making the world a better place—possible.

Fraud Processing With Cloudera Stream Processing

Cloudera and NVIDIA Help IRS Fight Fraud, Safeguard Taxpayers

Across the federal government, agencies are struggling to identify, organize, analyze, and act on troves of data. It’s a problem that leaders are working actively to tackle, but they’re in a race against immeasurable volumes of data that is continuously being generated in perpetuity in stores known and unknown. At the Internal Revenue Service, decades’ worth of data exceeds even the most cutting-edge processing capabilities.